We always love a good comeback story — especially when it comes to the U.S. oil boom.

Usually we’re rooting for the scrappy underdog, the play most people have forgotten about that suddenly erupts with a flurry of activity after a quiet decade.

That’s precisely what happened in North Dakota’s case. They’ve known since the 1950s that the Bakken held an enormous amount of oil… but it was only recently that companies were able to extract it.

Now there’s another comeback on the horizon for the U.S. oil sector.

And this story is different than North Dakota’s, because this place has been on top for decades.

Texas Oil Bonanza

It’s easy to get distracted by the famous Texas fields…

I’ve been starstruck on more than one occasion at the resurgence taking place in the state’s oldest oil plays, my attention fixated on areas like East Texas and the Permian Basin.

These two areas alone represent a huge chunk of history in the U.S. petroleum industry — and have carried our domestic production for decades.

Thanks to the East Texas Field and Permian Basin, the state’s oil output never averaged less than a million barrels per day over the last forty years.

What you might not realize, however, is that the largest oil-producing county in the entire state isn’t in either one…

No, that honor goes to another play making a name for itself in South Texas.

Karnes County: The Leader in Texas Oil

Had you asked me which county in Texas is producing the most crude oil, my bet wouldn’t have been south, but rather out west in the Permian Basin… somewhere like Andrews County.

And I would have been completely wrong.

Over 3.4 million barrels of oil flowed out of Karnes County during the month of February.

For the record, that’s well over a million barrels more than in Andrews County.

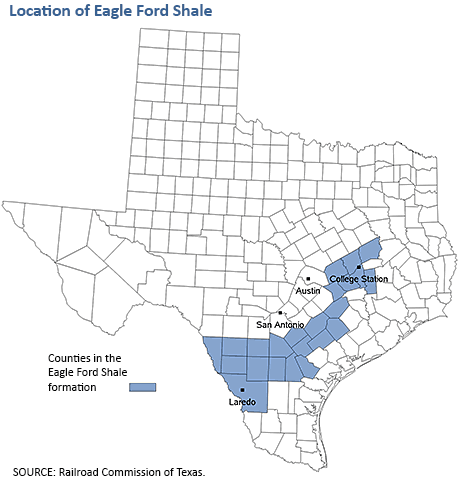

As you should be well aware by now, South Texas is home to the Eagle Ford Formation, which straddles 23 counties.

Consider Karnes County the epicenter of the South Texas oil boom. This is the only production zone in the area pumping out more than 100,000 barrels per day.

It’s also one of the reasons this formation is playing a huge role in the state’s oil revival that I just mentioned.

Yes, things would have turned out much differently without the 240 rigs drilling into this play…

What’s at stake? Up to 10 billion barrels of recoverable oil locked in the Eagle Ford, making it one of the largest oil deposits in the lower 48 states.

Comparatively, the USGS believes the Bakken and Three Forks formations collectively hold up to 7.4 billion barrels of undiscovered, technically recoverable oil.

Investing in the Eagle Ford Shale

Not surprisingly, we’re not the only ones interested in developing the Eagle Ford. That much is obvious when you look at the amount of money that has been poured into U.S. shale projects since 2008.

In 2011 foreign investors spent over $3 billion in joint ventures in the Eagle Ford; last year it was a little less than $2 billion.

About a month ago, we focused on one angle for investors to play: the infrastructure side of the Texas oil boom.

But this isn’t the only road to take…

I’ve always had a special place in my portfolio for drillers. These are the stocks responsible for the 74% year-over-year production jump in South Texas.

Take a closer look at EOG Resources, the largest leaseholder in the Eagle Ford, which has proven its long-term value for us so far:

Within the next four years, insiders are expecting Eagle Ford production to top 1.15 million barrels per day.

That means we’re staring at a serious boost in output over the next decade.

If Texas’ crude production is projected to double between now and 2020, there will be more than just three areas pushing production higher…

Later this week, I’ll delve into another up-and-coming play that will help keep Texas on top for decades to come.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.